This series may not be for everyone and the lamest way I could start it off would be by saying once upon a time I wanted to be an investor. If you have any questions regarding how well thought out that was, I would say just think about how many people you know who hand out business cards with the title “investor.”[i] If you still have a question regarding how well thought out that was, at the time I thought the efficient market hypothesis was foolish and that the stock market was beatable (and most specifically beatable with my personal intellect)[ii]. And after all of that, if you still have questions regarding how well thought out this was, my career plan for post-graduation was to pepper every big investment bank on the east coast with my resume and cover letter. What could go wrong? But after spending most of my senior year of college applying for jobs in the investment industry, I discovered that maybe that wasn’t in my immediate future. However, I managed to save some money and I realized there wasn’t anything stopping me from trying my darndest to prove out that theory in the market. I spent time researching different companies and industries, doing discounted cash flow and comparable analysis, and I settled on eight stocks with which to invest my money. Some three years later, I have found that the efficient market hypothesis has won. That I do not currently possess any knowledge or critical reasoning ability beyond that of the average investor and that all this effort yielded me very little in terms of financial gain.

But with all that said, there is more to learn and gain from failure than there is success. I think that it is time to diagnose what has happened over the past three years. To critically discuss the ideas I had and the mistakes I made in an effort to improve and gain a deeper understanding of this practice. But most importantly, to get back up, dust myself off and try again.

This will be an ongoing series as there is simply too much to discuss in one post. In this first post, I’ll simply present the portfolio I invested in and the results as of the latest date of this article. I will follow up with a broader discussion on my investment philosophy at the time with more posts on each specific stock and why I purchased it, along with a reflection on the results. At the end. I will try to determine what to do moving forward and discuss the broader markets at large with the hopes of gaining new insights through this reflection and experience. If this is a topic that interests you, I hope that it is as informative for you as it is for me.

It is important to state that none of this is a recommendation on what to invest in. As stated before, this is more of a what not to do. That doesn’t mean I didn’t have some successes and some good calls, but I do not want to be in the business of saying this is what people should invest their money in. Those decisions need to be made based on what you are looking for in terms of risk and reward, and it should hopefully be done in conjunction with a solid understanding of both the markets and the statistical improbabilities of beating them with an undiversified portfolio.

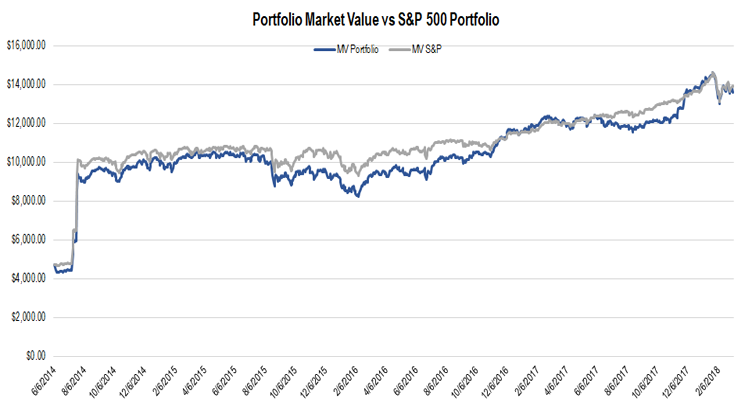

It should also be noted that for the sake of my own privacy, I have changed the total dollar figures to reflect a portfolio of $10,000, although that is not the figure that I have invested. I do not wish to disclose how much money was actually invested at the time and it is frankly irrelevant for the conversation. I think that this number is easy to understand and so I simply picked it and adjusted the below portfolio to have the same weighting for each stock as the actual portfolio of investments. Ultimately, the analysis should revolve around the percentages and not particularly nominal figures, but the nominal figures might help make these discussions more understandable and thus they are still important enough to include even if they are adjusted.

See Part 2 for the latest table with the results of the portfolio.

As of March 2018, over the course of the holding period, my portfolio has returned 36 percent. While on the surface that isn’t too shabby, the broader markets as represented by the S&P 500 returned 39.3 percent. If I had invested the same amount of money in the S&P 500 over the course of the same time period. What this demonstrates is that all of the work that I put in to trying to pick above average performing stocks actually was for not, as I could have done absolutely no work and gotten a better return by simply putting my money in an S&P 500 ETF such as the SPDR SPY. I should note that the S&P 500 figures do not include any fees associated with owning an ETF or mutual fund representing the broader markets, however I do not think that should be an important consideration at this stage given the fees for such financial instruments have come down considerably. The fees associated with the SPDR S&P 500 are .06 percent so for the sake of simplicity I have disregarded that issue. Additionally, this evaluation does not include dividend payouts. I was going back and forth on whether or not to include dividends in the analysis, as that is money that I have received and is surely a form of return. I really should have been reinvesting those dividends over the course of time. With the dividends included, the returns of my portfolio and the theoretical market portfolio are almost even. However, for the sake of the first post, I decided to keep things simple and as bleak as possible. But regardless of whether dividends and fees are included, the return I achieved is not a complete evaluation of portfolio performance.

This admittedly only tells half the story as it is also important to consider risk in this analysis. My next post will deal specifically with the notion of risk and returns, but I can already tell you that including risk does not paint a better picture, in fact it gets worse from there. As expected of a portfolio of 8 stocks, the risk to get these returns were much higher than a diversified portfolio of say 500 stocks like the S&P.

Yet I am afraid I am already getting too far ahead of myself in this discussion. I’d like to conclude this first post from some wise words from Confucius: “By three methods we may learn most wisdom: First, by reflection, which is the noblest. Second, by imitation, which is the easiest; and third by experience, which is the bitterest.” So with that notion, these are the bitter lessons I could have learned easily but I now must try to learn nobly. Part 2 is out and can be found here.

[i] Or people who still hand out business cards for that matter. I’ve been given business cards at most of my jobs, which is a nice gesture but I’m not Christian Bale in American Psycho.

[ii] To be candid, I still do think EMH does not hold in many financial markets but I’m willing to bend on whether my intellect is really up to the task as you will see from the rest of this series.