Every so often, our government goes through a process where Congress must approve the budget and spending limits for the upcoming fiscal year. As we have seen two times in recent history, our political parties are perfectly willing to use the debt limit and the potential for a government shutdown as a bargaining chip to extract political reparations from the party in power. Around this time, one party or the other raises the issue of the mounting US debt. In the news cycle, pundits will talk about this problem and for a month, maybe even two, this topic gets some attention. That is up until the two parties set aside their differences and pass a budget, knowing that not raising the debt ceiling is completely infeasible. As soon as this political game of chicken is over, we go on our way and the debt issue quickly recedes into the back of the collective American mind as it constantly gets pushed down the road for another time. The fact that Congress must vote to raise the debt ceiling is in and of itself a major problem. The national debt is not something to hold over the head of the opposition party. While I could go into detail regarding the most recent shutdown and the shutdown in 2013, the exercise would only highlight the degree to which this tactic accomplishes virtually nothing but the harm of government employees. The point is that the entire debt approval process is archaic and dangerous. But more importantly, the debt itself will inevitably become a problem if one party or the other does nothing to try to create a more sustainable governing model and set a real agenda for fiscal responsibility.

In 2016, the federal government spent 3.95 trillion dollars. One may ask, where exactly is the government spending all that money? The answer is mostly human services such as social security, Medicare, healthcare spending (which includes Medicaid), and income security. An additional 15 percent is spent on the military while over $200 billion goes to interest payments.

While this was the state of the budget several years ago, Congress recently passed a budget agreement that grew government spending by $300 billion with expansions to both military and infrastructure spending. While the bill was touted as a breakthrough (finally) for cooperation between the two parties, the issue needs to be raised regarding what it will take to at least attempt to curtail the problems that will eventually mount if the United States continues on this path. During the Obama administration, Republicans fostered a message of fiscal restraint and the party itself is regarded as the more resistant party when it comes to government spending. However, the reality is that Republicans are not against deficits nor are they against government spending. Republicans are against spending when the spending is going to things Republicans don’t agree with. The strategy is to cry foul about the budget deficit when Democrats are in power and then try to undermine Democratic legislation by simply under-funding them (case in point the Affordable Care Act). Once Republicans are tasked with the duty of actually governing, they promptly slash tax revenues which could add up to $1.4 trillion to the US deficit over the next 10 years per the CBO. That number might in fact be conservative because the expanded budget was not a part of that estimation.

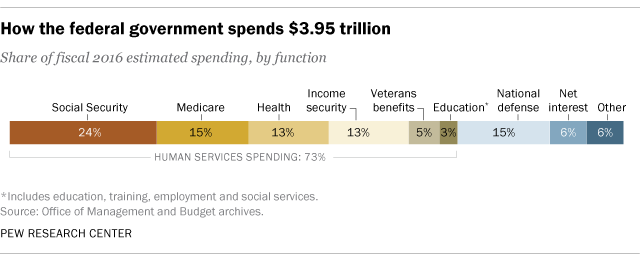

If you need further evidence of this trend, the following graph presents the US federal deficit in inflation adjusted dollars from 1913 to 2017. The red shading indicates Republican presidents while blue shading indicates Democratic presidents. The party of the President in power has very little predictive power over the direction of the federal deficit. The deficit is impacted by numerous factors such as the economy, but we also see that budget deficits have grown much wider and more persistent in more modern times. While Ronald Reagan is widely hailed as the standard of conservatism, Reagan was one of the largest tax and spend Presidents of the modern period. Reagan’s spending on the military is a form of government spending, and while some believe this lead to the destabilization of the USSR, I would contend that is a highly reductionist interpretation of the fall of the Soviet Union. The internal social changes along with the government policies of perestroika and glasnost had as much to do with the fall of the Berlin wall as the arms race between the US and Russia. Nevertheless, Reagan’s deficits were continued by the Bush Sr administration until the Clinton administration managed a balanced budget in the last three years of his White House tenure. These budget surpluses were do in part to tax increases that were passed during Clinton’s earlier years in office, but a booming economy and stock market are perhaps better explanatory variables for the three years of surplus. Additionally, Republicans certainly held Clinton’s feet to the fire in Congress during the budget approval process, forcing the administration to accept lower levels of spending. But again, this seems to be a result of opposition and political expediency on behalf of Republicans, not an honest and concerted effort to curtail government spending.

With several years of budget surpluses, President George W. Bush passed his own set of tax cuts in 2003. Bush in his inauguration address argued for a tax cut to boost growth, indicating the administration’s belief that the budget surplus should be returned to the American people. Military spending would then increase substantially, both due to Bush’s promises to expand the military’s budget but also as the United States would be involved in multiple foreign wars. This would then be compounded by the worst global recession in modern history that required heavy investment of taxpayer dollars to stabilize the US banking system. The Obama Administration inherited these deficits and managed some positive movement towards a balanced budget, again likely buoyed by a recovering economy which increases the tax base. The Obama administration extended the Bush tax cuts to ensure that the money supply did not contract during a time of economic recovery, ultimately electing to make most of the Bush tax cuts permanent in 2012. That brings us to today, where Trump’s first year in office expanded the federal budget and the trend will likely continue with the reduction of taxes on corporations and the restructuring of the income tax brackets.

The United States will likely maintain budget deficits well into the future for numerous reasons, but one major reason is that neither party has an incentive to either curb spending or increase government revenue. It is very easy to win votes by borrowing money from the future and handing it out to voters now, whether that is in the form of a tax cut or in the form of government programs. Therefore, I do not have faith that either party will be willing to look more than one election cycle into the future and understand that eventually between the debt burden the US is accumulating and the precarious if not irresponsible debt approval process that goes into making sure America pays its bills, the United States will undermine one of the biggest advantages our economy has which is borrowing at abnormally low rates. If deficits continue and the national debt continues to increase, there will be a day of reckoning where the American T-Bill will no longer be considered a “risk-free” asset, and America’s economy will suffer for not having that distinction. While investors generally operate on the assumption that the United States will not default on its debt, there is a point where investors will eventually need to challenge that assumption. It can be at a point where debt as a percentage of GDP reaches a certain level. It could be based on the political climate as both parties use the debt approval process as a weapon against the other party. But regardless, this trajectory is not sustainable and not just for the reason of maintaining the status of US debt as risk free.

As established earlier, the American government is essentially and insurance company considering approximately half of federal spending is tied up in paying out ongoing liabilities such as social security, Medicare, health spending like Medicaid, veteran benefits, and income security. What this means is that the current deficit does not fully reflect the total future liabilities of the US government. Social Security, the largest government expenditure, is particularly a problem. To understand why, one must understand how Social Security works (and what it is for that matter). The quick and dirty is Social Security was a government welfare program established by Franklin Roosevelt to help US citizens save for retirement. The basic way this works is that as you work you are taxed a portion of your income which is payed into Social Security. You will then be able to draw on this income after retirement to help supplement whatever additional retirement savings you have made. The caveat is that the money you pay into social security is not being saved and held in reserve until you are ready to withdraw it. The money you pay into social security today is used to fund the government payments of social security today. Fundamentally the system relies on there being more people paying into social security than they must pay out.

This creates a problem in that the amount of people relying on social security is growing faster than the amount of people paying into social security. Put in a different way, more people are retiring than entering the workforce. An additional issue is that as the standard of living increases, people live longer which means they draw on social security for longer periods of time. The combination of these trends means that by around 2034, the excess funds that the social security program has saved will be essentially dried up. The result would probably be that social security income for retirees would need to decrease by more than 20 percent to bring the income and payouts of social security into stable equilibrium.

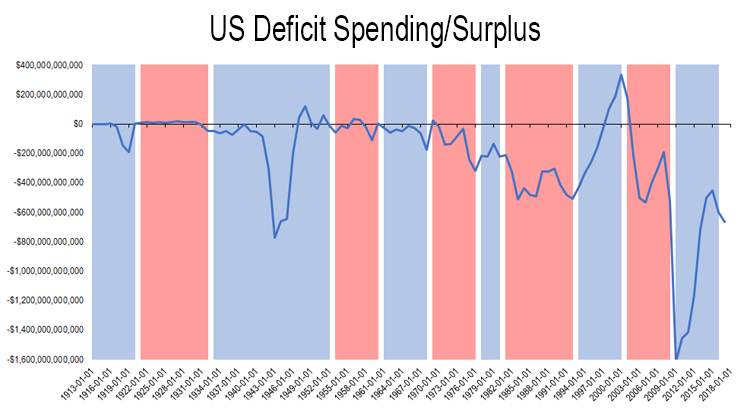

The point of all of this is simply that something has to give. As the government runs deficits, it must borrow money. Around three-fifths of US treasury bonds are owned by US institutions and investors. Essentially, this means that the government is soaking spending out of the economy and locking it up in US debt which is then distributed in one form or another as government spending or tax cuts. While there is certainly a lengthy discussion to be had on what the most effective form is, what one can say is that this continued deficit is unsustainable for the long term. I will not say that deficits are explicitly bad. The current level of US debt is not problematic and it is fine for governments to run deficits in numerous situations. What one must look more closely at is what the United States owns as a percentage of GDP. As that level rises, the ability of the government to pay back its debt in the future will be called into further question.

source: tradingeconomics.com

While national debt as a percentage of GDP is lower than levels we saw during WWII, I would generally contend that WWII was a rather unique circumstance and this maybe shouldn’t be used as the benchmark for the appropriate debt threshold.

While it is still too early to judge the result of the Trump tax cuts, it is not too early to assess that the result will be an increased whole in the federal budget which will need to be filled by US debt. I am simply afraid that party after party will continue to kick the can down the road for the sake of political expediency but at the expense of future generations of Americans who will have to bear the economic and financial weight of the decisions our politicians have made today.